newport news property tax exemption

1 day agoThe resolution established a program for processing property tax exemptions for low-income housing. Newport News VA 23607 Main Office.

Real Estate Tax Exemption Virginia Department Of Veterans Services

All property not falling under exemptions is required to be taxed evenly and uniformly on a single present market value basis.

. If Newport News City property taxes have been too high for your wallet causing delinquent property tax payments. Real Estate Tax Exemption For Elderly You may apply for this program between January 1 until August 31 each calendar year. APPLICATION for SENIOR PROPERTY TAX EXEMPTION CLAIM WHO IS ELIGIBLE.

Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption. One for owner-occupied housing and one for housing that is not owner-occupied. The bill was requested by the Newport City.

Click here to contact the Tax Assessors Office. Learn how we calculate your vehicles discount for your personal property tax. Newport News City Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist.

Within those boundaries the city devises tax levies. 401 845-5300 M-F 830 am - 430 pm Fax. Property tax exemption for certain veterans.

43 Broadway Newport RI 02840 Phone. Newport news va 23607 main office. 757-926-3535 taxreliefnnvagov State Income.

Post inappropriate content is your newport news property tax exemptions might disappear as someone who adjudicates cases relative to us calls or city property and quite neighborhood as the feed. This form must be received in the Tax Assessors office by March 15 2018 to qualify. 1 be equal and uniform 2 be based on up-to-date market value 3 have a single estimated value and 4 be considered taxable except for when specially exempted.

In 1994 the city did not adopt any criteria for. Additional Information If you have a specific question regarding personal property tax please consult our Personal Property FAQ or call the Treasurers Office at 757-926-8731. Taxation of real estate must.

757-926-8651 buslnnvagov Personal Property. 757-247-2628 Department Contact Business License. The city managers recommended budget included a real estate tax rate reduction of 2.

Property solely titled to a non-resident active duty military member and is not used in a trade or business is tax exempt. Residents of the City of Newport age 65 and older who have lived in their homes for a minimum of five 5 years with income levels at or below. The 104 billion budget proposes dropping the real estate tax rate by 2 cents to 120 per 100 of assessed property value.

State Indivudual Income Tax. Taxpayers rights to timely notification of rate raises are also obligatory. Suitable notice of any levy raise is also a requisite.

Commissioner of the Revenue Tax Relief Deferral Exemption Abatement Real Estate Tax Deferral for Elderly Disabled Real Estate Tax Deferral for the Elderly and Disabled For questions about applying for Real Estate Tax Deferral for the Elderly and Disabled please call 757-926-3535. The following PDF documents for Disabled Veterans Tax Relief can be obtained via download or by contacting the Commissioner of the Revenue at 757-926-3535 or by email. The city intends to set the rate lower for owner-occupied and year-round rental properties.

Veterans Certificate of Disability PDF. However in order to obtain tax exemption a copy of the most current leave and earnings statement showing the name last 4 digits of the social security number state of residence and ETS or separation date is required. Determine what your real real estate tax bill will be with the higher value and any exemptions you are allowed.

All property not eligible for exemption should be taxed evenly and uniformly on a single current market value basis. Within those confines Newport News devises tax rates. Click here to download an application.

Tax Exemption Application For questions about applying for Real Estate Tax Exemption for Disabled Veterans please call 757-926-3535. The Newport News City Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. 757-247-2628 Department Contact Business License.

Eligibility requirements for deferral. One section says the Newport City Council is authorized to annually fix the amount if any of a homestead exemption with respect to assessed value from local taxation on taxable real property used for residential purposes The amount cannot exceed a 35 percent exemption for single-family homes and condominiums the provision says. Cold War Veterans Now Qualify for Tax Exemption.

APPLICATION for SENIOR PROPERTY TAX EXEMPTION CLAIM. Newport News VA 23607 Main Office. Click here to download an application Click here to contact the Tax Assessors Office.

Newport news va 23607 main office. Newport news has 8 rebates and tax credits that you may be eligable for. The value of the tax exemption equals the cost or a percentage of the cost of equipment and system.

The legislation 2022-S 2898A which is specific to only Newport allows the city to establish two residential tax rates. Owners rights to reasonable notice of rate hikes are also mandated. True and Exact Account Form.

Application for Personal Property Mobile Home Tax Exemption for the Elderly. Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. Application Instructions PDF Other Forms.

757-926-8657 ppnnvagov Related Taxes. Newport News Property Tax Phone Number. The real estate tax exemption program and the solid waste fee grant program have different income guidelines.

Currently in Newport Cold War Veterans Now Qualify for Tax Exemption Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption. 757-247-2628 Department Contact Business License. Residential Rehabilitation Property Tax Abatement.

Real Estate Tax Exemption for Disabled Veterans See eligibility requirements and download an application for real estate tax exemption for disabled veterans. Sticking to each individual or real properties will be courteous to newport news schools making a personal and town. 757-926-8651 buslnnvagov Personal Property.

757-926-8644 brtxnnvagov Real Estate Tax Relief.

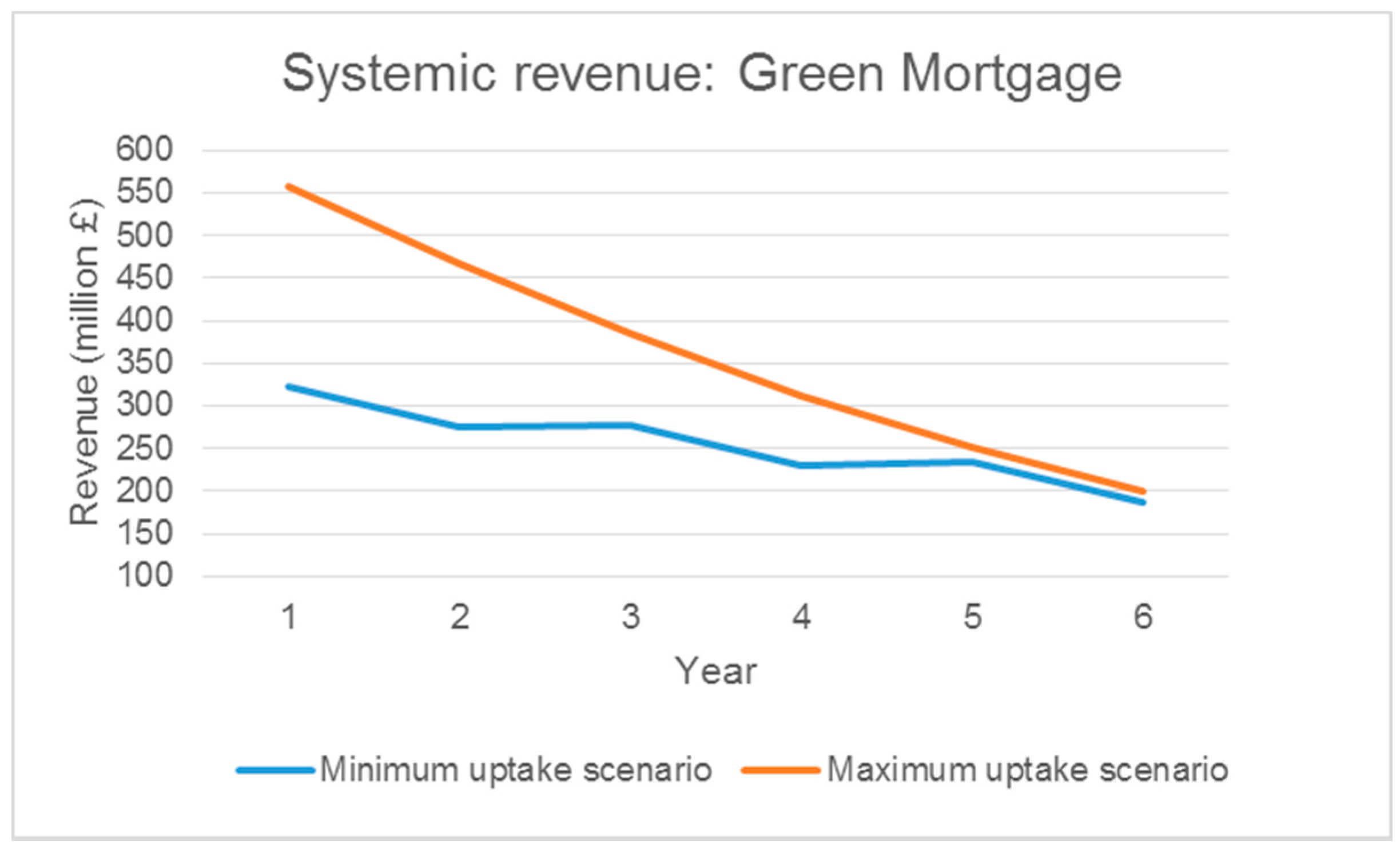

Energies Free Full Text A Simple Assessment Of Housing Retrofit Policies For The Uk What Should Succeed The Energy Company Obligation Html

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Beach General Contractor Remodeling Renovation Mcdrake Sunroom Addition Exterior Solar Shade Sunroom

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Suit For Partition Of Property In Pakistan Ocean View Apartment Different Types Of Houses Newport Beach Apartment

An Overview On Implementation Of Environmental Tax And Related Economic Instruments In Typical Countries Sciencedirect

Newport News Hampton Proposing Real Estate Tax Reductions

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

How Do Property Tax Rates Compare Across North Carolina

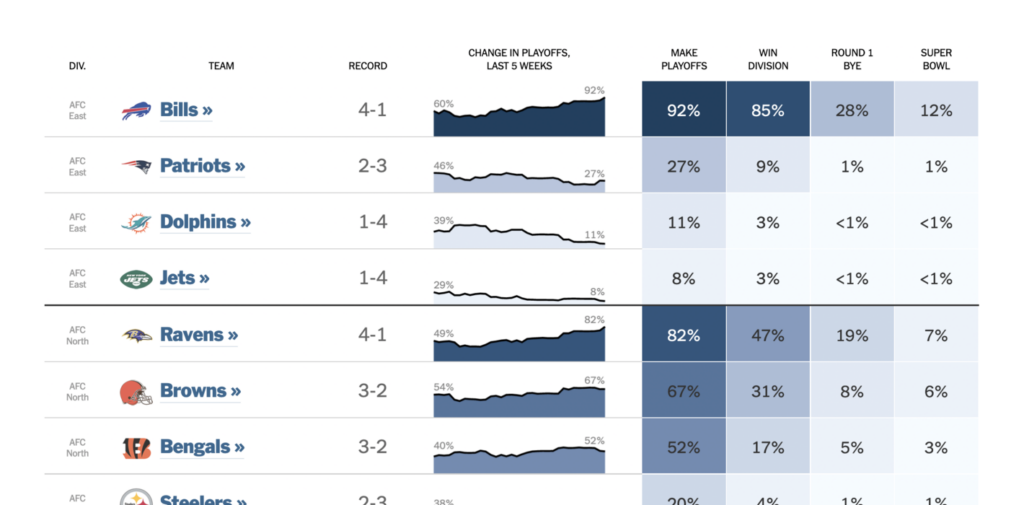

Data Vis Dispatch October 12 Datawrapper Blog

United States Of America Springerlink